Post Office Saving Schemes can offer ensured returns which implies that you can stay certain of the way that you will not lose any well-deserved cash. These plans additionally guarantee two-fold the cash you put resources into every one of their reserve funds plans with lesser financing costs.

So, if you are planning to invest in the right place, then you may check out the below-provided investment schemes that will help you to get the best ROI.

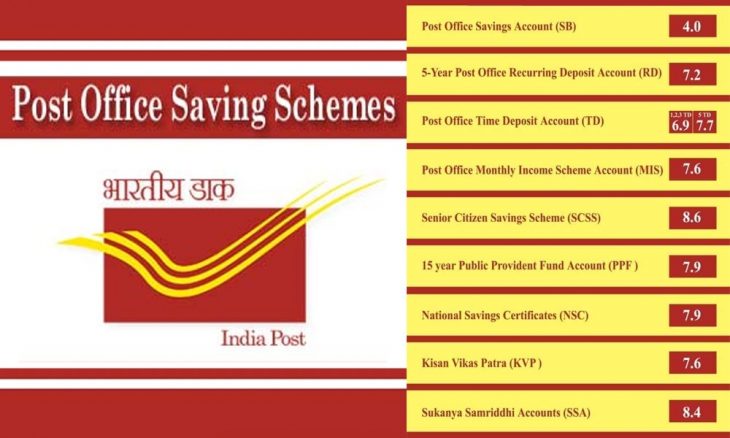

1. Post Office Time Deposit: The 5.5% financing cost is being offered to 1 year to 3 years’ time store (TD) of the mailing station and on the off chance that you put resources into it, your cash will twofold in around 13 years.

2. Post Office Sukanya Samriddhi Account: The Sukanya Samriddhi account plan of the mailing station is offering the most elevated revenue of 7.6% and this plan will require 9 years to twofold the cash.

3. Post Office Recurring Deposit: The 5.8 percent premium on the Post Office Recurring Deposit (RD) is being offered if the cash is put and it will twofold in around 12 years.

4. Post Office Monthly Income Scheme: The 6.6 percent premium is given on the Post Office Monthly Income Scheme (MIS), if the cash is put and it will twofold in around 10 years.

5. Post Office Senior Citizens Savings Scheme: The Senior Citizen Saving Scheme (SCSS) of the Post Office is right now paying a premium of 7.4% and it copies your cash in 9 years.

6. Post Office Kisan Vikas Patra: As of now, 6.9 percent interest is being given in the mail center Kisan Vikas Patra (KVP) plot. With this loan cost, the sum put here pairs in 10 years and 4 months.

7. Post Office PPF: The 15-year public opportune asset (PPF) of the mail center is as of now giving a 7.1 percent premium which will require around 10 years to twofold your cash going on like this.

8. Post Office Saving Bank Account: Post Office bank account offers just a 4.0 percent premium on your venture, and your cash will twofold in 18 years.

9. Post Office National Saving Certificate: The 6.8% premium is offered on the National Saving Certificate (NSC) of the mailing station which is a 5-year reserve fund plan and if the cash is contributed with this loan cost, it will twofold in around 10 years.