The Reserve Bank of India (RBI) has informed that bank clients will not utilize the constant gross settlement (RTGS) after the end of business hours on April 17, 2021, to 2 pm on Sunday, April 18, 2021. India’s Central Bank has referred to the specialized redesign of its RTGS office as the explanation for this transitory closure.

In its authority articulation, the RBI said, “A specialized redesign of RTGS, directed to upgrade the versatility and to additionally improve the Disaster Recovery Time of the RTGS framework, is booked after the end of business of April 17, 2021.”

The RBI has additionally guided banks to illuminate their clients with the goal that they can design their instalment activities likewise. In then, clients can exploit the National Electronic Fund Transfer (NEFT) administration to work with their assets during this period.

What Is The Distinction Among RTGS And NEFT?

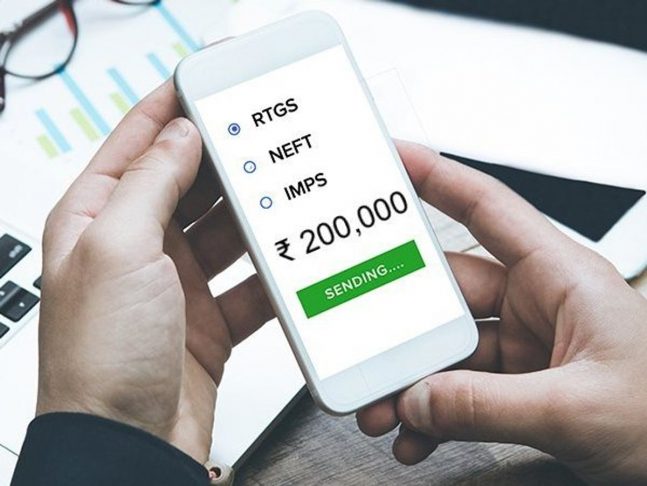

Both RTGS and NEFT are advanced instalment modes offered by the bank to move cash in a snap, through RTGS exchanges one can manage large transactions. One can send assets above Rs 2 lakh through RTGs. There is no such breaking point with the NEFT administration.

So, the RTGS administration is liked for moving huge amounts of cash while NEFT is favoured when you need to move not as much as Rs 2 lakh. Additionally, remember that clients can move up to Rs 25 Lakh each day through NEFT exchanges.

Image Credit: Times Now