NEFT is one of the best modes to transfer money from one account to other. Under this Scheme, people, firms, and corporates can electronically move assets from any bank office to any individual, firm, or corporate having a record with some other bank office in the nation partaking in the Scheme. Despite the fact that there is no restriction forced by the RBI for reserves to move through the NEFT framework, a few banks might put some limits dependent on their own danger discernment with the endorsement of its Board.

Your banks should be a piece of the NEFT finances move the organization and the framework should be NEFT empowered for the assigned bank office. The rundown of bank-wise branches which are partaking in NEFT is given on the site of the Reserve Bank of India

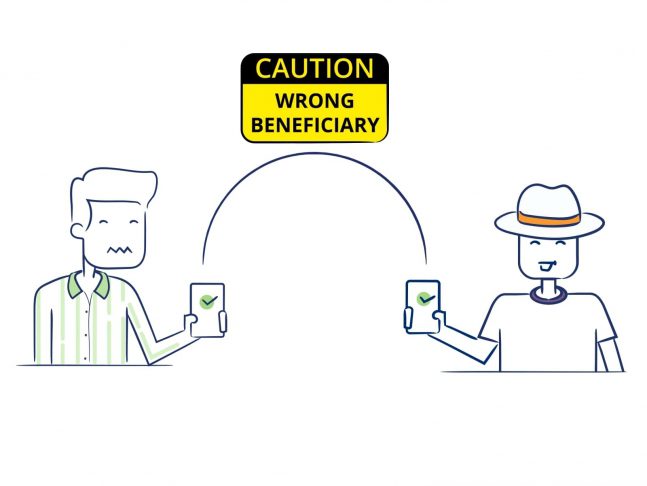

Be that as it may, prior to doing an NEFT, clients should know about certain fundamental subtleties needed for dispatching assets through the framework. There are a few fundamental components of a recipient’s distinguishing proof.

Here are 5 things in regard to the recipient’s recognizable proof you need to deal with while doing NEFT

1. Recipient’s Name

2. Recipient’s Branch Name

3. Recipient’s Bank Name

4. Recipient’s Account Type and Beneficiary’s Account No.

5. Recipient’s Branch IFSC

It is to be noticed that with impact from July 1, 2019, handling charges and time fluctuating charges required on banks by Reserve Bank of India (RBI) for outward exchanges embraced utilizing the RTGS framework, as additionally the preparing charges imposed by RBI for exchanges prepared in NEFT framework was deferred by the Reserve Bank.

Advantages of NEFT:

1. Office accessible 24×7 on Internet (Retail and Corporate) and Mobile Banking Channels w.e.f. sixteenth December 2019.

2. No compelling reason to stress over misfortune/burglary of the actual instrument or probability of fake encashment

3. Profoundly financially savvy, you get an affirmation of the settlement through SMS or email within two hours

4. Solace to execute from anyplace (if you pick web banking or portable banking as the mode)

5. Works with close to continuous asset move safely

You can start an NEFT exchange utilizing both of the accompanying modes, Web banking (Corporate and Retail), mobile banking as well as by visiting the bank.

Image Credit: Tezzbuzz