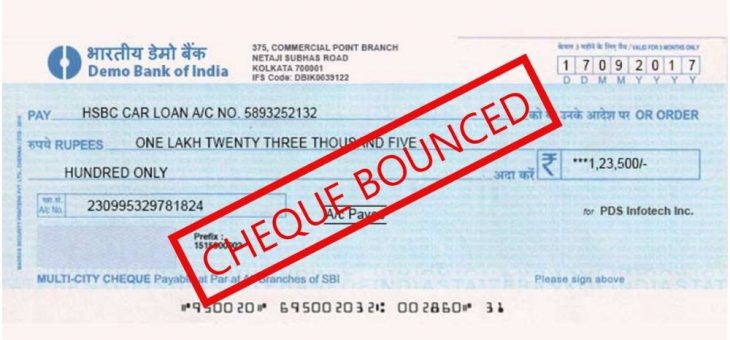

Bank clients who have a propensity for utilizing checks for making different installments should guarantee that they have an adequate amount to clear the cheque consistently 24×7. The Reserve Bank of India (RBI) came out with another arrangement of rules in regard to changes to the financial guidelines from this month. With the new principal change, checks can be gone through on a Sunday or an occasion as well. The clients should remember that they need to keep a base equilibrium in their ledger consistently. On the off chance that they neglect to do as such, the check might bob, and they should suffer a fine or consequence.

In any case, the clients, who are prone to clear their minds a functioning day, need to change their activities in light of the fact that, with the new guideline change, checks can be gone through on a Sunday as well. This new standard is less tedious,

Before the new guidelines, the clients didn’t need to stress over a check going through at the end of the week, however with the new changes, it’s a significant change by the way they lead their financial exercises.

RBI new standards of all day, everyday mass clearing office

During every other month’s financial strategy audit in June, RBI Governor Shaktikanta Das had declared that to additional improve the accommodation of clients, the NACH will be accessible on the entire day of the week. This office has been made accessible on the entire day of the week, viable August 1, 2021.

How might every minute of everyday mass clearing office advantage check clients?

This change has been carried out in all public and private banks. So, the new change will profit the check client more as given checks can be gone through even on a vacation.

What is NACH?

NACH is a mass installment framework worked by the National Payments Corporation of India (NPCI) that works with one-to-many acknowledge moves like an installment of profit, interest, compensation, and benefits. It additionally works with the assortment of installments relating to power, gas, phone, water, occasional portions towards advances, interests in common assets, and protection charges.

Image Credit: Trak. in