Blog

Advantages for using Credit Card

Credit cards often referred to as plastic money, are payment instruments which allow the user to borrow money within the stipulated credit limit towards making payments for purchases and transaction. The borrowed amount needs to be repaid before its due date, and the...

Advantages of Using a Demat Account

Demat or a dematerialized account is a form of account which is used to hold shares and other financial instruments in a dematerialized form. In simpler words, it is similar to our savings account, but instead of carrying cash, it holds shares and other financial...

Debit Card vs Credit Card

Credit cards and Debit cards might often appear identical and offer multiple standard features. Both debit cards and credit cards have a unique 16-digit card number, personal identification numbers or PIN codes, an expiry date, and a CVV number. Common Features of...

Things to Consider Before Investing in a Mutual Fund

You surely have heard the phrase, “Mutual fund investments are subject to market risks, please read the offer document carefully before investing” after every mutual fund advertisement, and this is for a good reason this disclaimer. Mutual funds do have risks...

Difference Between Nifty and Sensex

A market index can be referred to as the weighted average of a group of stocks listed on a stock market. Market indexes such as Sensex and the Nifty act as the representation of the whole stock market and helps investors and trader track the overall changes in stock...

Technical Analysis Vs Fundamental Analysis: Which is better?

When you hear that you should research before investing, it usually implies either undertaking fundamental analysis or technical analysis of the stocks or financial instruments you might be interested in investing in. While the end-goal of both these forms of...

How to Invest when in Debt

While investing in a healthy habit, no one likes to live under debt. With this, the question often arises, whether should some invest when they are in debt. The answer to this is, it entirely depends upon your situation. Analyze your Debt Situation It would be best if...

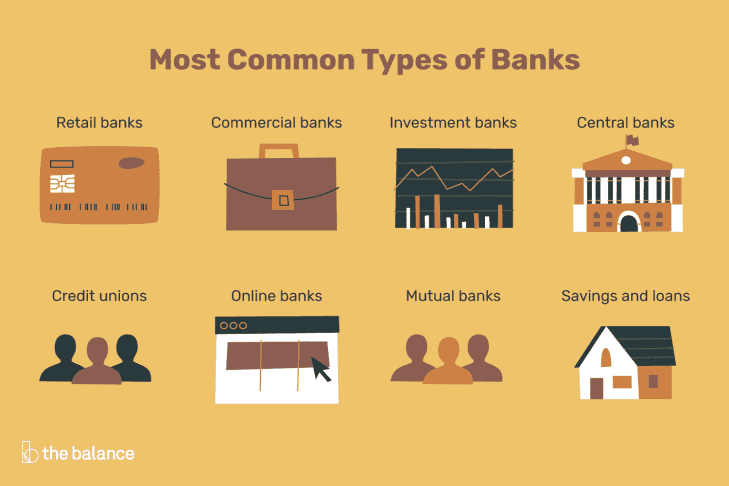

Different Types of Loans for Retail Customers

The Indian Banking Sector has grown leaps and bounds with almost 50 different nationalized banks operating within India, both in the public and private sectors. And let's not forget the hundreds of co-operative bank and regional banks which work across the country....

Different Types of Mutual Funds in India

Mutual funds can be referred to as the accumulation of money from multiple investors who wish to invest and grow their money through investment. This corpus is managed by professionals who invest on behalf of the investor in various assets classes, depending upon the...