Blog

Easily Check The PF Balance With Simple 4 Ways Online, SMS, Missed Calls, Umang App

EPF is a legal body Central Board of Trustees had in March this year cut the loan cost on representative fortunate asset stores to a four-decade low. Loan fees on EPF were diminished to 8.1 percent for the monetary year 2021-22, down from 8.5 percent the earlier year....

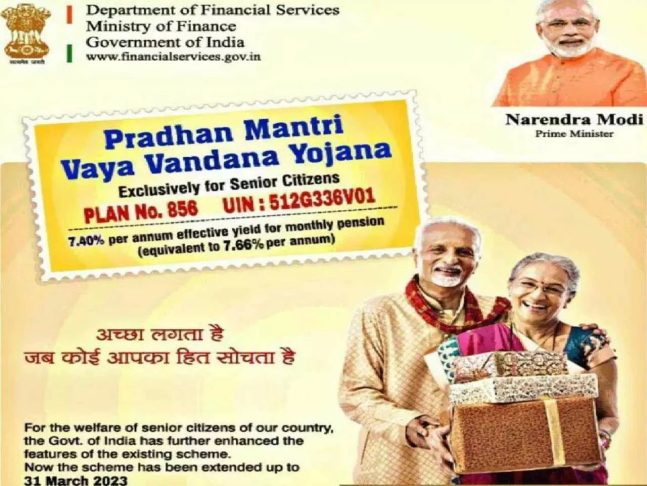

Pradhan Mantri Vaya Vandana Yojana That Offers Multiple Benefits To Senior Citizens!!!! All About Eligibility, Benefits, Taxation

The Pradhan Mantri Vaya Vandana Yojana (PMVVY) is one of the most famous annuities yojanas for the advanced age populace. This plan was presented on May 26, 2020. The Government of India has changed the benefits rate under this plan and broadened the time of offer for...

PAN/ TAN Card: What is a TAN card, how is it different from a PAN card, and how to Apply for it?

PAN card is mandatory for filing taxes and all taxpayers are well familiarized with the PAN (Permanent Account Number) card. But do you know about the TAN cards? TAN is also a tax-related document. However, people have less information about TAN cards. They do not...

EPF Balance Increased: Your EPF balance will increase by 66%. Know the New Government Rules.

The New Wage Code is at a pace these days, discussing the new pay scale rules. Many things are written and said about this, but the central government has made no formal announcement. However, it will be a significant concern for the people working in the private...

Senior Citizen Card: Thousands of Benefits. Know Complete Details Here!

The government creates senior citizens cards because of the large population of seniors and their ongoing challenges. This card, commonly known as a Senior Citizen ID Card, is designed for seniors over 60. This card is similar to an identity card that includes the...

Cheque Bounce New Rule: New rule for Cheque bounce, and money will be deducted from another account. Details Here.

You must read this news if you use a bank cheque. The Finance Ministry is exploring several measures to deal with cheque bounce cases, such as deducting money from another account of the cheque's issuer and prohibiting the opening of new accounts in such...

Tax Saving Schemes: Save Income Tax, by Investing in these Schemes – Get more Benefits with Strong Returns

This is a good opportunity for you if you work and want to start investing. You can invest in government-issued plans where the government offers the benefit of tax-saving plans if your wage falls within an income tax bracket and you pay taxes simultaneously. Today,...

Tax Rules on Diwali Gifts. Know What the Rules Are?

Diwali is quickly approaching. On Diwali, everyone enjoys giving and receiving gifts. Gifts come in many forms, including money, candy, clothing, and gold ornaments. Giving extravagant gifts on Diwali, such as cars and real estate, is also considered lucky. Even the...

ITR Filing Alert! You can be fined Rs 5,000, even if you have filed ITR. Know the details immediately.

You are wrong if you have already filed an income tax return and think your work is done. And in this situation, there is a risk of paying Rs 5,000 late fee or penalties. So, this is necessary to complete this work. Verifying your income tax return is a crucial...