Blog

Money myths that can affect your financial situation

People start thinking about old myths while putting money, spending, and saving. Often people are in a circle of many statements and myths regarding investment, spending style, and saving money. The myth does not apply to everyone, maybe one has ever thought of...

You should avoid these type of financial mistakes during this crisis

COVID-19 has influenced world markets and individuals at various levels. A number of measures have been taken by the Governments to avoid this crisis so that the economy can survive. Governments worldwide are now working to derail economies to sustain livelihoods...

Are you having trouble handling your salary? Follow these easy steps to avoid money issues

When the salary comes to the bank account, it is perfect to see it. The feeling of your hard-earned money in your bank account is something special. However, many people, especially those whose first job has recently been engaged, do not know how to manage their...

Now you have to pay stamp duty on Mutual Funds: Know here how it will affect investment

Yes! you have read right that on the 1st July 2020 mutual fund, investors will have to pay stamp duty. This will affect the returns received by the investors. After investing in mutual funds, stamp duty will be levied at the rate of 0.005% at the time of allotment of...

Insurance or Investment which one is more crucial for future planning

One of the major problems with the new earning youth is that they may have to decide between insurance and investment. Which of these two they choose. In addition, it is also necessary to achieve financial goals such as buying a house, starting a business, investing...

How to get maximum return on PPF account: Read here

The Public Provident Fund (PPF) is a prevalent long term investment option in India. There are many reasons for this. These include high returns, tax benefits, and sovereign guarantees of interest and principal. By investing in this scheme, investors can also deposit...

Know here how you can get maximum return on your PPF account

The Public Provident Fund (PPF) is a prevalent long term investment option in India. There are many reasons for this. These include high returns, tax benefits, and sovereign guarantees of interest and principal. By investing in this scheme, investors can also deposit...

Here are some best investment options: Here you get secure and guaranteed return

When it comes to investing your hard-earned money, a number of investment options are taken into account where capital security and better returns are most important. Investors are going through challenging times in the current corona crisis. Life was easy before...

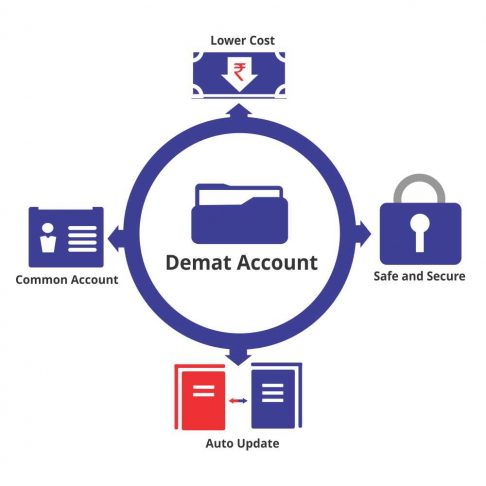

What is the importance of Demat account?: What are the benefits of it?

India has added 5.3 million investors as compared to April 2019 by April 2020, and this figure is equivalent to almost the entire population of New Zealand. With the joining of new investors, new Demat accounts have been opened. The objective is to facilitate the...