Blog

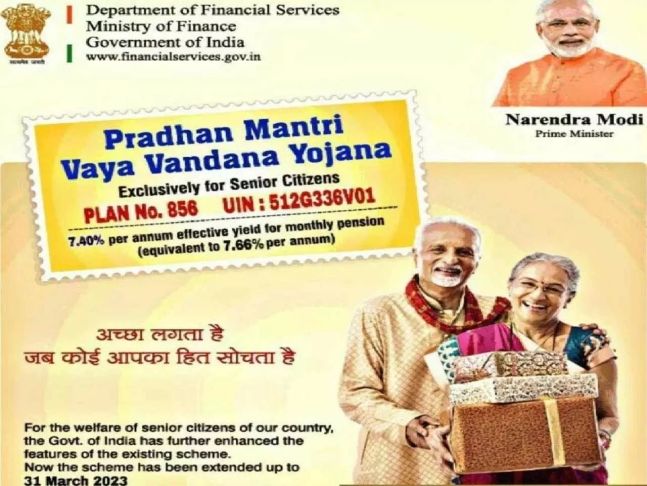

Pradhan Mantri Vaya Vandana Yojana That Offers Multiple Benefits To Senior Citizens!!!! All About Eligibility, Benefits, Taxation

The Pradhan Mantri Vaya Vandana Yojana (PMVVY) is one of the most famous annuities yojanas for the advanced age populace. This plan was presented on May 26, 2020. The Government of India has changed the benefits rate under this plan and broadened the time of offer for...

Senior Citizen Card: Thousands of Benefits. Know Complete Details Here!

The government creates senior citizens cards because of the large population of seniors and their ongoing challenges. This card, commonly known as a Senior Citizen ID Card, is designed for seniors over 60. This card is similar to an identity card that includes the...

Tax Saving Schemes: Save Income Tax, by Investing in these Schemes – Get more Benefits with Strong Returns

This is a good opportunity for you if you work and want to start investing. You can invest in government-issued plans where the government offers the benefit of tax-saving plans if your wage falls within an income tax bracket and you pay taxes simultaneously. Today,...

NPS Pension Scheme: Good news! Get a pension of Rs 75,000 every month after retirement. Know How?

Do you want a monthly pension of Rs 75,000 after retirement? You can invest in NPS. The NPS is regarded as the best method of retirement planning. This is a government scheme where a sizable sum can be raised till retirement, provided the money is deposited on a...

Post Office Scheme: Deposit Rs 1500 every month, and you will get 35 lakh rupees. Details Here.

The market is flooded with various investment opportunities, and many of these plans also offer quite alluring schemes. Some of these, meanwhile, also involve risks. However, many investors favor safe investment schemes with modest returns due to their low risk. ...

Fixed Deposit Interest Rate: Before opening FD, check which banks give you the highest returns in 3 years. See details.

A fixed deposit is one of the easiest ways to grow your money. An initial lump sum deposit earns you yearly interest. Compounding allows this money to grow over time into a sizable sum. Savings for post-retirement are common. Many people invest money in FDs to address...

NPS Withdrawal Rule Changed: You can withdraw the NPS amount before retirement. Know the process.

As people prepare for retirement, they invest in a variety of policies. The National Pension Scheme (NPS) is viewed as a good alternative among a wide variety of pension plans currently available on the market. NPS has the potential to improve both your retirement and...

7th pay commission: Dearness allowance will increase by 42% from 2023. Know the Latest Updates.

For central employees, the upcoming year is going to be much better. The planning for the increase in his compensation would begin as early as 2023. First, however, they will automatically receive a gift called a dearness allowance. It is accessible now and will...

Post Office Senior Citizens Scheme: Get more than Rs. 2 lakh guaranteed interest on Rs. 5 lakh deposit. Know scheme details.

The Post Office's Senior Citizen Savings Scheme (SCSS) is a popular savings program. This program has been specifically created to meet the needs of senior citizens after retirement. The main feature of this plan is that it must be invested in one lump sum and that...