by pankaj | Jul 24, 2024 | Investment News

The Public Provident Fund (PPF) is a prevalent long term investment option in India. There are many reasons for this. These include high returns, tax benefits, and sovereign guarantees of interest and principal. By investing in this scheme, investors can also deposit...

by pankaj | Jul 24, 2024 | Investment News

When it comes to investing your hard-earned money, a number of investment options are taken into account where capital security and better returns are most important. Investors are going through challenging times in the current corona crisis. Life was easy before...

by pankaj | Jul 24, 2024 | Investment News

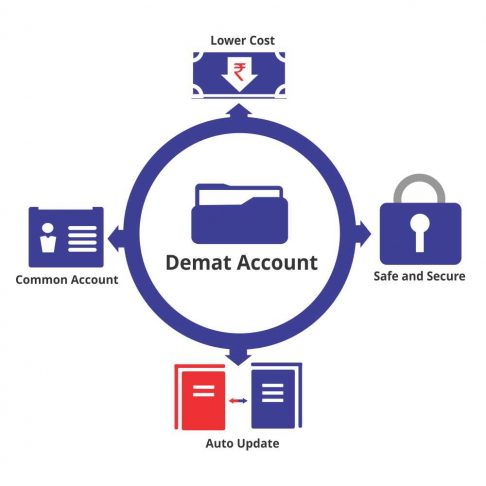

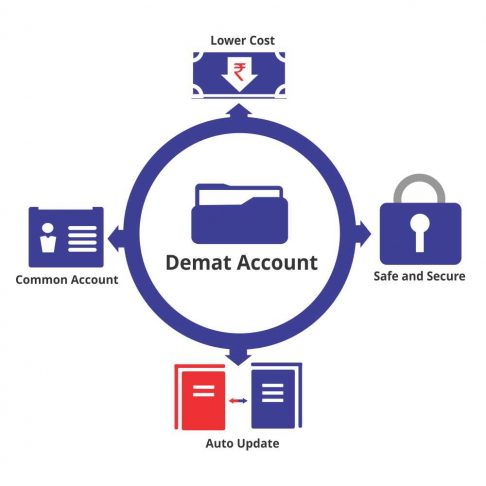

India has added 5.3 million investors as compared to April 2019 by April 2020, and this figure is equivalent to almost the entire population of New Zealand. With the joining of new investors, new Demat accounts have been opened. The objective is to facilitate the...

by pankaj | Jul 24, 2024 | Investment News

It’s more important to earn and save money on today’s world than where you invest it. Because if you don’t know where your money is going, it can be the biggest mistake for you. Talking about investment is considered to be the biggest way to invest...

by pankaj | Jul 24, 2024 | Investment News

There is no need to be an expert to get good returns from any investment. But if you are not an expert, it is better to recognize your limitations. You have to pay attention to the future productivity of the buyable asset. If it is not being calculated as to what the...

by pankaj | Jul 24, 2024 | Investment News

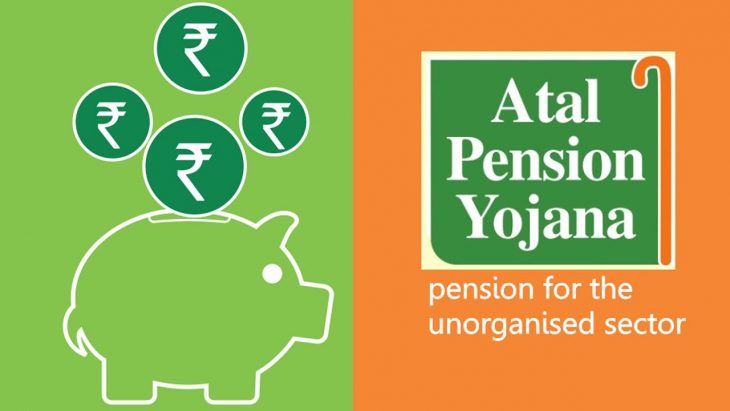

Atal Pension Yojana (APY) is a guaranteed pension scheme launched in the year 2015. It is mainly for the poor, the underprivileged, and the unorganized sector workers. The scheme is operated on behalf of PFRDA. Any Indian citizen from 18 to 40 years can join the...