Customers using Credit Card will often discuss CIBIL scores. CIBIL score is crucial for taking a loan from a credit card or bank. The CIBIL score determines whether the loan will be received or not, and if you get it, how much will it get. Many times people do not understand what it is about the CIBIL score and the CIBIL report. Today, we are telling you about the CIBIL score and the CIBIL report in this article.

What is CIBIL report

The CIBIL report includes all the information about your credit history. This includes personal information, contact detail, job-related information, loan account, credit details. The last 36 months of your credit history are seen to prepare the CIBIL report.

What is CIBIL Score

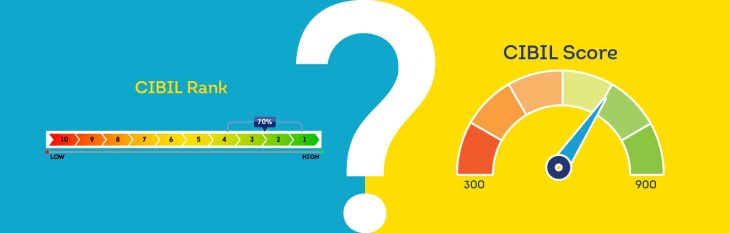

The CIBIL score mentions three points. This shows whether the loan has been paid in time or not, you have never missed the loan, you have completed the payment of interest. Every information related to your credit card is in the CIBIL score. CIBIL score explains how you have taken a stand in the payment of the debt in the last 24 months. More than six months of credit information is taken by the customer to prepare the CIBIL score. CIBIL score varies between 300 and 900. Usually, a score close to 750 to 900 is considered good for loans.

The most common thing is that both the CIBIL report and the CIBIL score determine your loan eligibility, only after seeing it, the lenders give the loan. So if you are thinking of taking a loan from the bank or you have already taken a loan, you should keep your CIBIL score strong. Repay the loan in time. Do not miss the loan payment date.

Read also: IRDAI announced companies to collect Health Insurance Premiums in Installments

Have you got the first Credit Card? Tips to remember before using it

Know here the difference among EPF, PPF, and GPF account

Image credit: cibil