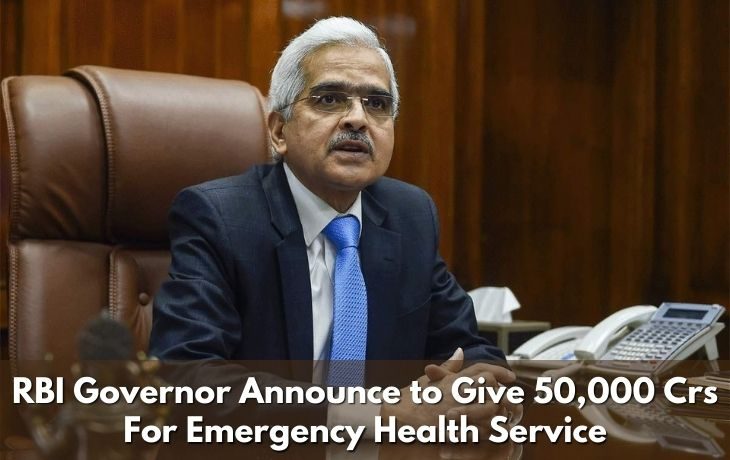

RBI has come right into it in the midst of the second rush of Corona infection. Tending to the media, Reserve Bank of India (RBI) Governor Shaktikanta Das said that there might be a few declarations today. The economy has been influenced constantly wave of Corona. He said RBI is observing the circumstance in Corona. He said, after the main rush of Corona, there was a decent recuperation in the economy.

RBI Governor said, there was a quicker recuperation in India than in the remainder of the world. The Meteorological Department has anticipated a typical rainstorm this year. Because of a good rainstorm, request in provincial regions is probably going to increment.

The RBI Governor said that considering the spread of the second flood of COVID-19, broad and speedy activities are required. Shaktikanta Das said that the Reserve Bank will watch out for the arising conditions identified with COVID-19.

Economy misfortune by lockdown RBI Governor Shaktikanta Das has forced lockdowns and other COVID-prompted limitations in a few states to stem the second rush of the COVID-19 pandemic, which is relied upon to hurt the economy.

Large Steps for Vaccine Manufactures

Das gave Rs 50,000 crore for Emergency Health Services. Through this, banks will give credits to antibody producers, immunization transport, exporters in simple portions. Aside from this, clinics, wellbeing specialist organizations will likewise get this advantage. He said credits and impetuses will be given soon for the need area. There is a major declaration by the RBI for the pharma foundation. Overdraft office will be given for the states. States will get concessions in overdraft.

Banks to make COVID Loan Book

RBI Governor said that Covid advance books will be made for Priority Sector. Banks will make COVID Loan Book for them. You will acquire 40 premise focuses more under invert repo.

10,000 Crore TLTRO for SFB

RBI declared long haul repo activities for little money banks (SFBs) up to Rs 10,000 crore. It will be utilized for credits up to 10 lakh rupees for each borrower.

A Few Changes In KYC Rules In The Current Circumstance

The RBI lead representative said that taking into account the current circumstance, a few changes have been made in the KYC rules. KYC has been affirmed through video. RBI has permitted the utilization of Limited KYC till 1 December 2021.