State Bank of India (SBI) permits individuals to benefit from Gold Loan by vowing gold trimmings including gold coins sold by keeps money with the least desk work and low financing cost. The base gold advance sum you can apply through SBI YONO is Rs 20,000 while the greatest credit sum is Rs 50 lakh. The pace of revenue at present SBI is offering on gold advance to the clients is at the pace of 7.5%. The advance residency will be of three years (12 Months if there should be an occurrence of Bullet Repayment Gold Loan-an an item having no reimbursement commitment during the advance tenor).

SBI has additionally postponed off the dispossession charges and pre-installment punishment for clients.

Applying for advance by means of YONO SBI has numerous advantages:

Application for an advance from the solace of your home

Least loan cost at 8.25% (0.75% concession is accessible up to 30.09.2021)

Less desk work

Less handling time

Less in-branch pausing

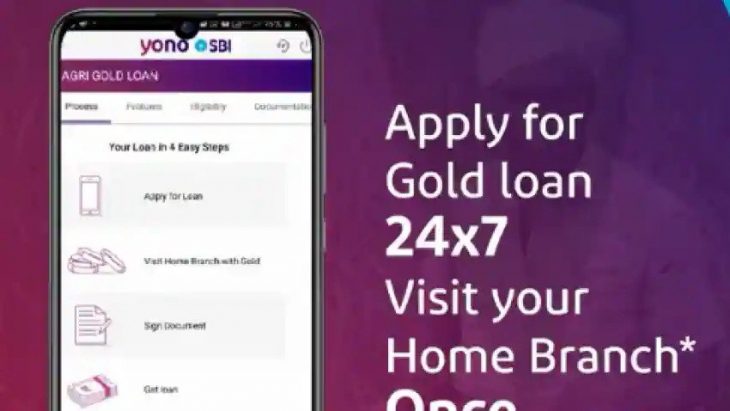

Here is the manner by which to benefit gold credit utilizing YONO SBI in 4 simple advances:

1. Apply for advance

a. Login to your YONO account

b. On the landing page, click on the menu (three lines) on the top outrageous left

c. Snap-on advances

d. Snap-on Gold Loan

e. Snap-on Apply Now

f. Fill in decoration subtleties ( type, amount, Carat and Net weight) alongside any remaining subtleties accessible in the dropdown ( Residential Type, Occupation Type), fill the Net Monthly Income, and present the application

2. Visit branch with gold

a. Visit the branch with gold to be vowed, 2 photographs, and KYC records

3. Sign record

4. Get advance

Who can benefit SBI Gold Loan?

People more than 18 years old with a consistent type of revenue including

Beneficiaries (No Proof of pay required)

What are the archives needed for benefiting the SBI gold advance?

Application for Gold Loan with two duplicates of photos

Evidence of Identity with confirmation of Address

Image Credit: Zee Business