The Reserve Bank of India (RBI) has taken an unscheduled choice along these lines expanding the repo rates by 40 bps to 4.40%, taking everybody asleep. The Repo rate is the rate at which banks acquire from the RBI. The move will raise getting costs for corporates and people since almost certainly, banks will give the weight of the climb to the clients. This implies that Loans and EMIs will wind up being pricey from now.

The following are 4 significant regions where the average person will be impacted by RBI’s abrupt rate climb

Interest In Home Credits

This ascent in loan fees will eventually affect generally obtaining costs for homebuyers – and may hose private deals somewhat. Tragically, for home purchasers, this climb flags an impending finish to the record-breaking low-interest system, which has been one of the significant drivers behind home deals the nation over since the pandemic started.”

Rising Natural Substance Cost To Saddle Private Area

Increasing loan fees and inflationary patterns in fundamental unrefined components in development including concrete, steel, work cost, and so on will add to the weight of the private area, which did essentially well in the past quarter – Q1 2022, Puri has additionally said in his investigation.

Higher Vehicle Credits

RBI’s transition to building the repo rate by 45 premise focuses will make vehicle credits costly, said a high-ranking representative of the Federation of Automobile Dealers Association (FADA).

While the traveler vehicle fragment might have the option to retain this shock because of long holding up periods, the bike section is as of now reeling because of a failure to meet expectations provincial market, vehicle value climbs, and high fuel costs. Exorbitant financing costs for vehicle credit because of RBI’s move will be an unexpected blow for this fragment.

Further Rate Climb Looks Inescapable

An SBI report has assessed that further rate climb by the RBI looks inescapable. Assuming rates are overall continually re-examined, it will just seat the borrowers – – meaning the greater weight of EMIs. With the ongoing climb of 40 bps in repo rate to 4.40%, it appears to be the rate cycle has turned around (from the precarious cuts seen in mid-2020) and RBI would keep on expanding the rates going ahead and may arrive at the pre-pandemic degree of 5.15% by end March 2023, according to the SBI report.

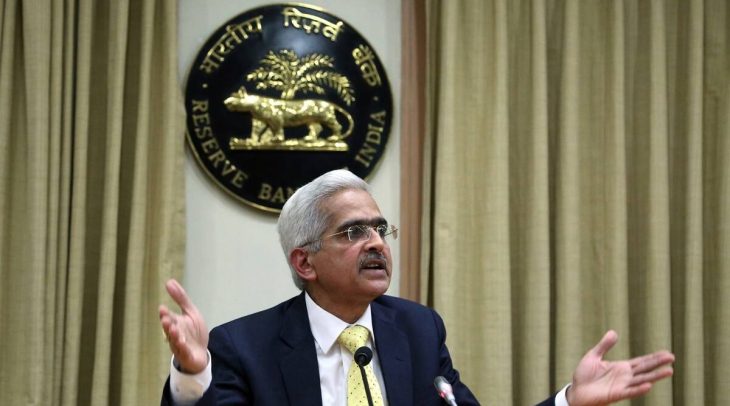

Image Credit: DigitNews