Blog

Mastering EPFO e-Nomination: Everything You Need to Know

You must create an e-nominee in your PF account if you are a member of the Employees Provident Fund Organisation (EPFO) and you do so. Almost all types of savings policies, including life insurance, bank accounts, mutual funds, provident funds, and other similar...

The Benefits and Challenges of Commercial Real Estate Investment: A Professional Perspective

Commercial real estate investment is a lucrative venture that can lead to substantial financial rewards. However, like any other investment, there are both benefits and challenges with commercial real estate investing. This blog post will explore the benefits and...

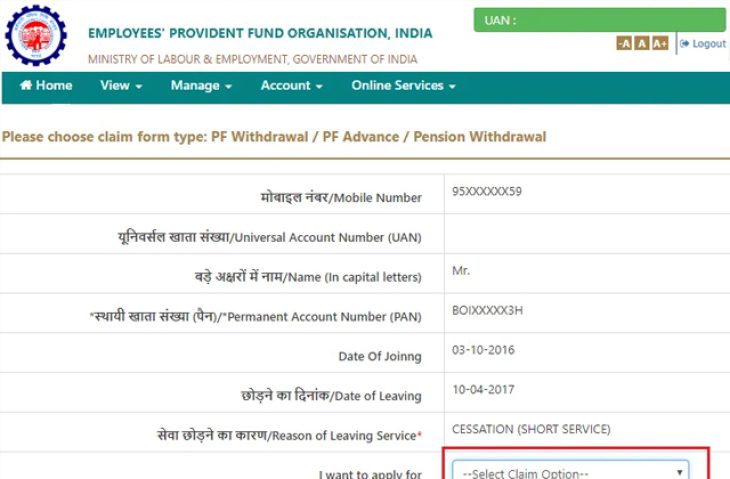

PF Account: Essential Documents Required for PF Withdrawals

PF Account: It has also frequently happened that people have to take PF money early owing to certain circumstances. To prevent you from encountering any issues, we will go into depth regarding the procedure for withdrawing PF funds. Let's discuss it. PF Login: Every...

Maximizing Retirement: Top Investment Options for Senior Citizens

When it comes to investment options for senior citizens seeking higher returns for retirement, it's important to consider a combination of factors, including risk tolerance, financial goals, and the need for liquidity. Here are some best investment options to explore:...

Expert Tips for Successfully Growing Your PF Money for Retirement

Growing your PF (Provident Fund) money to meet your retirement goal requires a strategic approach and long-term planning. The PF is a significant source of retirement savings for many individuals, and maximizing its growth potential is crucial for ensuring a...

Understanding the Differences Between Active and Passive Mutual Funds

A common investment option for many people seeking to diversify their portfolios and maybe earn returns is mutual funds. One important distinction to understand when considering mutual funds is the difference between active and passive mutual funds. Here's a...

Investing in Special Fixed Deposits: A Comprehensive Guide

A particular FD, also known as a fixed deposit or time deposit, is a financial instrument offered by banks and financial institutions to people and businesses. It is a type of investment where an individual deposits a specific amount of money with a bank for a...

Invest Smartly with SBI’s 400 Days Special FD

State Bank of India (SBI) accepts FD investments from individuals. The bank introduced the unique FD program Amrit Kalash Scheme to provide further incentives to the consumers. The bank has extended the investment deadline, initially set for June 30, until August 15,...

Women’s Special Scheme: How to Benefit from 32k Interest and Compound Growth on 2 Lakh!

A special plan just for women! Nirmala Sitharaman, the finance minister, introduced the fiscal year 2023–2024 budget and mentioned the Mahila Samman Savings Certificate. For women, this is a fantastic small-savings plan. This short-term lump sum investment plan has...