PF Account: It has also frequently happened that people have to take PF money early owing to certain circumstances. To prevent you from encountering any issues, we will go into depth regarding the procedure for withdrawing PF funds. Let’s discuss it.

PF Login: Every month, a portion of the wages of those in employment is undoubtedly contributed to the Employees Provident Fund (EPF). People feel at ease collecting money for retirement as a result. However, it has also frequently happened that people have to use PF money early owing to certain circumstances. To prevent you from encountering any issues, we will go into depth regarding the procedure for withdrawing PF funds. Let’s discuss it.

Who can withdraw PF money?

>> The ability to withdraw PF ought to be subject to specific requirements. PF money can only be withdrawn because of these eligibility requirements.

>> At least 90% of the corpus can be withdrawn before the first year of retirement.

>> You are eligible to receive up to 75% of the money after one month of unemployment. Once the person secures employment, the remaining sum will be transferred to the new EPF.

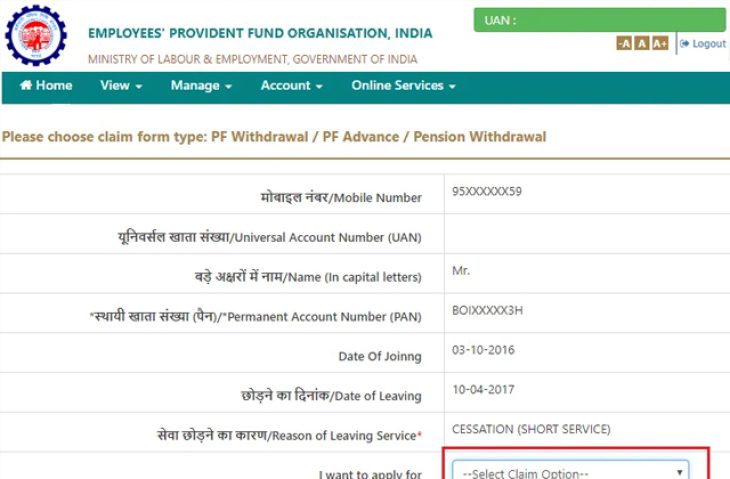

>> To withdraw the funds from EPF account, you must have a valid UAN linked to your bank information, including your Aadhaar and PAN.

Document Required

The following documentation must be submitted to withdraw EPF:-

>> A certified copy of the applicant’s KYC records, such as an Aadhaar card, voter ID, passport, or driver’s license.

>> A canceled cheque or updated bank passbook, or any other document can be used to confirm the applicant’s bank account information.

>> If the employee withdraws EPF prior to five years of continuous employment, ITR Forms 2 and 3 are required.

>> Bank account details.

>> If you deposit the money into your bank account, a revenue stamp.

>> Properly completed EPF claim form.

Pay Attention

To make an online withdrawal from your EPF account, your cellphone number must be linked to your Aadhaar card number. Remember that withdrawals can be processed quickly and with little paperwork online. You don’t have to go to the Employees’ Provident Fund Organisation (EPFO) or your prior employer’s office to get verified.