Nowadays, the Unified Payment Interface (UPI) is the favored technique for exchange. With UPI’s developing fame, clients ought to know about any alterations to the agreements of purpose. HDFC Bank, India’s biggest private loan specialist, late reported that it had changed its UPI Terms and Conditions. The bank has a ticker running on the landing page of site peruses, the UPI Terms and Conditions have been changed. If it’s not too much trouble, read our refreshed agreements by clicking here. Bank clients that need to utilize UPI to create installments can do as such.

Clients ought to know that there is an everyday exchange limitation of Rs 1 lakh or ten exchanges each day, which is determined on a 24-hour premise. The 10-exchange impediment just applies to support moves and doesn’t make a difference to charge installments or dealer exchanges. Moreover, during the initial 24 hours on an Android telephone and 72 hours on an iPhone, new UPI clients or the individuals who have as of late changed their gadget/sim/versatile number might have the option to execute up to Rs 5,000.

HDFC Bank’s UPI T&C says this:

1. Clients who wish to utilize the UPI Facility through the Bank’s App should finish a one-time enrollment in the structure, way, and substance recommended by the Bank, and the Bank claims all authority to acknowledge or reject such applications at its only prudence.

2. Clients who apply through the TPAP App should follow the cycles framed on the TPAP App.

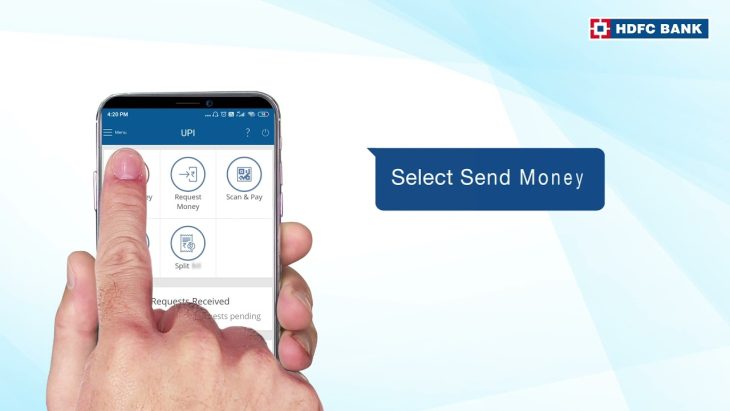

3. The User will actually want to make a virtual installment address and start exchanges utilizing UPI through the Bank’s application.

4. Clients can join their other ledgers through a one-time enlistment process indicated and normalized by NPCI, and afterward start executing with them.

5. By applying for and utilizing the UPI Facility, the User consents to be limited by these Terms, which oversee the Bank’s arrangement of administrations.

Acknowledgment

1. Client’s demonstration of straightforwardly or in a roundabout way, getting to, utilizing as well as taking advantage of the Services of the Bank or any part thereof under the UPI Framework, will without anyone else (with next to no further demonstration, deed or composing and with practically no mark required), sum to User’s unavoidable and unrestricted acknowledgment of the Terms and such access, use or advantage will without anyone else further go about as the affirmation of the User having perused and perceived and permanently and unequivocally acknowledged the Terms.

Image Credit: Youtube